Professor Zsuzsanna Vargha and her co-author demonstrated through the case of Hungary how the European convergence narrative, not the securitized market, was central in forming optimistic expectations and thereby led to the Eastern European equivalent of the sub-prime mortgage crisis.

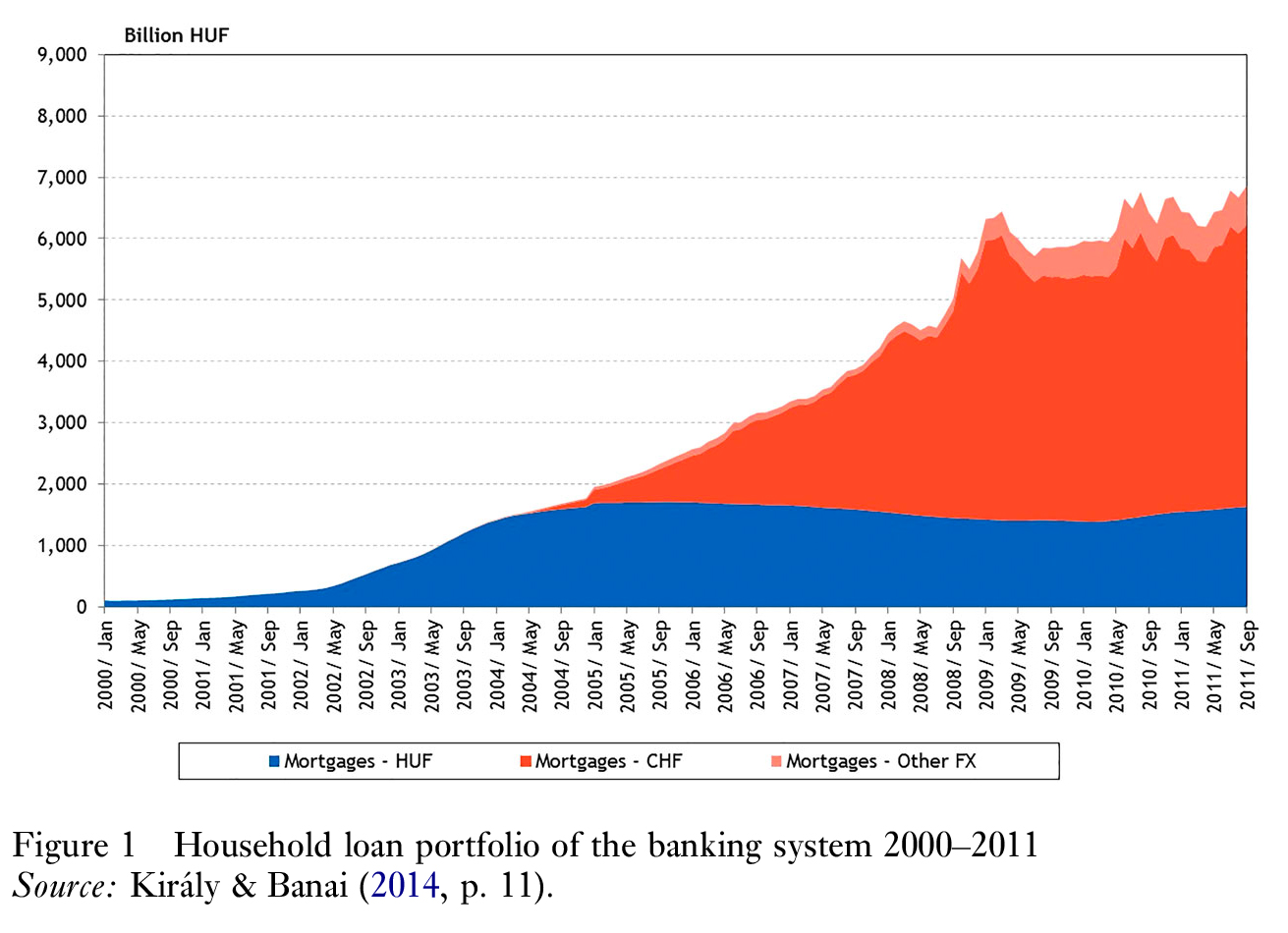

Between 2003 and 2010, the Hungarian mortgage market experienced a spectacular fourfold growth from $3.6 billion to $14.4 billion. The growth was fuelled by foreign-currency-denominated “Forex” mortgages (mortgages which are repayable in a currency other than the currency of the country the borrowers are residents of, Swiss Francs in this case). These could be obtained at substantially lower interest rates than Hungarian “Forint” loans, but they were repayable in Forint (the Hungarian currency) at the current exchange rate. As the US financial crisis reached Europe, the Forint plummeted. Monthly payments on Forex mortgages grew by as much as 80–90 per cent, and defaults soared. Anger at the foreign banks that dispensed the Franc loans even helped to bring Viktor Orban, Hungary’s prime minister, to power in 2010. Similar crises swept through the region, causing what some in central banking referred to as the Eastern European equivalent of the sub-prime mortgage crisis.

Between 2003 and 2010, the Hungarian mortgage market experienced a spectacular fourfold growth from $3.6 billion to $14.4 billion. The growth was fuelled by foreign-currency-denominated “Forex” mortgages (mortgages which are repayable in a currency other than the currency of the country the borrowers are residents of, Swiss Francs in this case). These could be obtained at substantially lower interest rates than Hungarian “Forint” loans, but they were repayable in Forint (the Hungarian currency) at the current exchange rate. As the US financial crisis reached Europe, the Forint plummeted. Monthly payments on Forex mortgages grew by as much as 80–90 per cent, and defaults soared. Anger at the foreign banks that dispensed the Franc loans even helped to bring Viktor Orban, Hungary’s prime minister, to power in 2010. Similar crises swept through the region, causing what some in central banking referred to as the Eastern European equivalent of the sub-prime mortgage crisis.

Starting from a reflection that existing accounts focusing on “knowledge failures” to foresee the financial crisis are not adequate to understand the broader set of “simpler crises”, ESCP Management Control Department Professor Zsuzsanna Vargha and Università della Svizzera italiana’s Léna Pellandini-Simányi began to unpack the varied ways in which countries outside the Western core jumped on the optimistic bandwagon. “In recent years, a substantial literature has emerged on why economic actors did not see the US and UK sub-prime crisis coming, and found the core cause in the securitized markets’ intractable complexity. The ‘toxic’ mortgages of the Eastern European region, however, were neither securitized nor sub-prime,” they explain in the article they published in Economy and Society. Swiss franc mortgages were lent out largely to middle-class borrowers and were kept on banks’ books. Unlike the chains of mortgage securitization, foreign-currency lending was a transaction that banks and regulators understood, at least for the most part. “This ‘simple crisis’ compels us to ask why actors did not see it coming,” they write. “Specifically, what were the sources of optimistic expectations of key institutional actors about mortgages in the period leading up to the crisis? (…) One source of optimistic expectations that our research revealed as particularly pertinent through the case of Hungary, one of the hardest-hit countries of the region (along with Poland, the Baltic States, Bulgaria, Romania and Ukraine), is the European convergence narrative.”

The securitized market lost in translation

The Hungarian Professor and her co-author based their study on archival research and interviews with bankers, regulators and legislators, and they used recent theories of expectations, which understand the roots of optimism as both pragmatic and fictional practices that commonly incorporate narratives. “We showed that optimistic expectations were based on a narrative of European convergence, which translated the uncertain future into a seemingly certain spatial trajectory leading towards the European Union, adds Zsuzsanna Vargha. “Fusing the underspecified convergence process with an orientalist geographical imaginary, this narrative and its associated measures allowed actors to interpret growing indebtedness as ‘catching up’ to the more developed Europe, de-emphasized exchange rate risk through a belief in European convergence and precluded crisis scenarios originating in the European Union.” They argue that this narrative did not simply acknowledge the ongoing EU and future Eurozone accession process. Rather, it tackled uncertainty by mobilizing the older, developmentalist Westernization narrative prevalent in the region. The convergence narrative fell back on the developmentalist narrative’s tropes when uncertainty arose; and it was the developmentalist narrative’s legacy that lent the convergence narrative legitimacy and power to withstand contradicting information.

Based on their findings, Zsuzsanna Vargha and her co-author also contribute to theories of how economic expectations are formed, stabilized and maintained by developing the concept of “spatializing the future”. This refers to expectation-formation practices that handle uncertainty by charting the future as a movement through concrete geographical or abstract space along externally verifiable pathways. “In our case from Eastern Europe, expectations were stabilized by a European convergence narrative which was embedded in a cartography, through which a spatial trajectory could be charted from Hungary to an idealized destination, the European Union,” they write. “This cartography was populated with Western European destinations and milestones along the path, as well as with countries in Hungary’s peer region whose position helped to establish whether Hungary was on the right track and moving at the right speed. Albeit referencing real geographical places, the manner in which these places were selected and causally linked into a trajectory of Hungary’s future was deeply interpretative. Actors charted diverse pathways by drawing selectively on the actual and presumed economic facts of convergence.”

Based on their findings, Zsuzsanna Vargha and her co-author also contribute to theories of how economic expectations are formed, stabilized and maintained by developing the concept of “spatializing the future”. This refers to expectation-formation practices that handle uncertainty by charting the future as a movement through concrete geographical or abstract space along externally verifiable pathways. “In our case from Eastern Europe, expectations were stabilized by a European convergence narrative which was embedded in a cartography, through which a spatial trajectory could be charted from Hungary to an idealized destination, the European Union,” they write. “This cartography was populated with Western European destinations and milestones along the path, as well as with countries in Hungary’s peer region whose position helped to establish whether Hungary was on the right track and moving at the right speed. Albeit referencing real geographical places, the manner in which these places were selected and causally linked into a trajectory of Hungary’s future was deeply interpretative. Actors charted diverse pathways by drawing selectively on the actual and presumed economic facts of convergence.”

Campuses